International Power has demonstrated the ability to execute acquisitions at the right time and at the right value, together with the capability to integrate newly acquired assets quickly and seamlessly.

- A portfolio approach: a balanced portfolio in terms of geographic spread, fuel diversity and contractual position

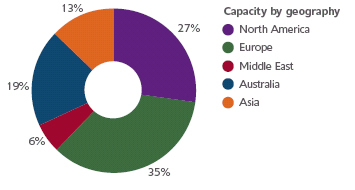

- Broad geographic spread through five core regions - North America, Europe, Middle East, Australia and Asia

- Our portfolio approach gives us access to multiple opportunities to create value whilst mitigating risks

- 28,800 MW (gross) power generating capacity in 18 countries

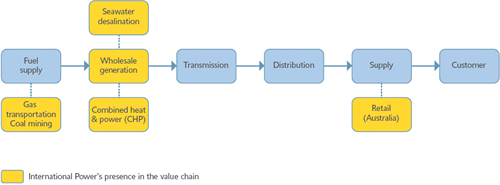

- Successful developments in linked businesses: desalination, steam and district heating, electricity retail, opencast mining and gas transportation

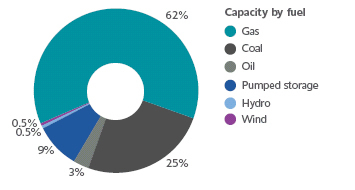

- Comprehensive plant operation skills. Capabilities to produce electricity through thermal, hydro, pumped storage and wind technologies using different fuel types: gas, oil, coal and renewable resources

- Since 2000, the Group has nearly doubled its generating capacity through successful acquisitions and greenfield developments in our core markets

- The demand for electricity in our markets is growing at rates ranging from 2% to 9%

- Non-recourse project debt is a fundamental building block, and a prudently balanced capital structure provides flexibility to execute growth without overstretching the balance sheet

- We have strong commercial skills to structure and negotiate long-term power contracts in regulated markets such as Asia and the Middle East

Together with generating power, we use our capabilities to successfully and profitably develop closely linked businesses. These include wholesale production of fresh water through seawater desalination, production and distribution of steam, district heating via cogeneration, a small but growing electricity retail business, open-cast coal mining and gas transportation.

A portfolio approach

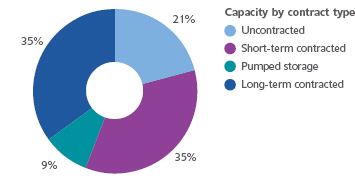

We add value and manage risk through a portfolio management approach, which involves maintaining a balance in the portfolio in terms of geographical spread, fuel diversity and contractual position. This portfolio approach gives us access to multiple opportunities to create value whilst mitigating the risks associated with over exposure to any particular market, fuel or contract type.

Geographically the business is focused in five core regions - North America, Europe, Middle East, Australia and Asia. Our balanced geographic presence gives us access to growth opportunities with attractive risk reward profiles whilst protecting the overall business from a downturn in any particular market.

The portfolio approach also extends through to our operational capabilities. We are able to operate a range of power plant technologies namely thermal, hydro, pumped storage and wind. These technologies produce electricity using different fuel types that include gas, oil, coal and renewable sources such as wind and water. This operational flexibility allows us to capture opportunities that are most economic and best suited to the market in question.

As electricity is a critical service for any economy, governments carefully decide whether or not they wish to liberalise this key sector. Several governments have retained full control of the sector and others have fully liberalised both the production and supply of electricity. The skills required for investing in liberalised (merchant) or non-liberalised markets are very different - and we have both.

The government-controlled markets offer opportunities to sell power to government bodies via long-term contracts that offer stable and regulated returns. Assets in the liberalised or merchant markets are subject to the forces of supply and demand and these markets are generally cyclical and more volatile. Hence these markets generally offer a higher risk/high reward environment for investments.

International Power maintains a balanced presence in both types of markets, providing the business with a stable platform of contracted earnings and cash flow overlaid by merchant generation which offers greater upside potential.

Capabilities

International Power's high quality asset portfolio, together with the capabilities of its teams around the world, form a strong combination for revenue optimisation, effective risk management and future growth in earnings and cash flow.

Through its heritage, International Power has in-depth experience in plant operations and engineering. This experience is invaluable not only for ensuring smooth plant operations, but also to ensure we understand all operational and technical issues relating to the potential acquisition or development of new power plants. Today, the Company has skills to execute power projects right from inception through to the delivery of power in the most advanced and complex traded markets of the world.

International Power portfolio as at March 2006

The Company's core capabilities can be categorised into the following seven areas:

Greenfield development and construction management: We have excellent experience of developing large capital intensive infrastructure projects - from selecting the appropriate site to securing multiple government/stakeholder approvals and project managing the entire construction programme right through to successful commercial operation. International Power's successful growth in the Middle East is the most graphic example of our greenfield development expertise, where, in the last six years the Company has developed six major projects with a total value of approximately £3.8 billion.

Acquisitions: International Power has demonstrated the ability to execute acquisitions at the right time and at the right value, together with the capability to integrate quickly and seamlessly newly acquired assets into the portfolio. An excellent example of International Power's acquisition capabilities is the successful acquisition of the EME international asset portfolio which was completed in late 2004. All nine assets were smoothly integrated into the portfolio and have since met or exceeded financial and operational performance targets.

Financing: Given the very capital intensive nature of our business, the ability to fund projects is vital for success. International Power has consistently proven its financing capabilities through the execution of numerous greenfield and acquisition fundings, together with re-financings of existing assets. We have done this in different parts of the world, under different circumstances and through the combined use of local and international capital. As examples, Shuweihat S1 and Umm Al Nar in the Middle East were both financed in a challenging geopolitical environment, and Saltend was the first merchant plant in the UK to be financed in over five years. Non-recourse project finance is at the core of International Power's financing strategy and capital structure - this provides the most appropriate level of debt for each asset and also excellent risk mitigation for the Group.

Plant operations: We have comprehensive power station operational experience and skills. Through-life engineering and maintenance plans, meticulously implemented, ensure maximum availability and are key for delivering value in both our merchant and long-term contracted markets. Effective plant operations are enhanced by ensuring information is shared around the portfolio and key operational staff are rotated to different assets on a regular basis.

Long-term contract expertise: We have strong commercial skills to structure and negotiate long-term power and water contracts in regulated markets such as Asia and the Middle East. Under these contracts, key cost risks such as fuel and turbine maintenance are mitigated through long-term hedging and supply arrangements. Overall, the contracts provide visibility and stability of earnings and cash generation over the long-term.

Trading: We operate in a number of merchant markets throughout the world. We have developed the skills necessary to maximise our returns in these markets, with a practical focus on co-ordinating trading and operations to ensure we optimise our returns by having our plant available whenever our trading teams see value. For us, trading means selling the physical output generated by our plant. Our traders operate within strict guidelines and risk policies to ensure our traded position is carefully monitored and managed. This includes matching fuel purchases with power sales and carrying out only a very limited amount of proprietary trading. Where possible we will forward sell output if we consider the return is favourable, which provides some certainty for near-term earnings and cash flow. We also ensure that lessons learnt in all our markets - for example the new environmental legislation in Europe relating to CO2 allocations - can be shared with the rest of the business.

Asset management: All our investments have to deliver expected performance on a standalone basis first, and then as part of the regional and global portfolio. Through regular and robust technical, commercial and financial reviews, the corporate headquarters and regional offices together monitor the performance of each asset in the portfolio. We work to ensure that we maximise fleet efficiencies where we operate plants with similar technologies, for example through global spare parts supply agreements or by bringing certain engineering services in-house. In addition, we have a Health, Safety and Environment Committee which co-ordinates the Group's activities and enables best practices to be adopted at all plants. This co-ordinated approach helps us manage operational risk and extract the full portfolio benefits.

Opportunities to grow

Since demerger in October 2000, the Group has grown significantly, nearly doubling our operational capacity through successful acquisitions and greenfield developments in our core markets.

Demand for electricity is growing in all of our markets, with growth rates ranging from 2% to 9%. This underlying growth in demand offers us two kinds of investment opportunities - investments to meet incremental demand and investments to replace existing older, less efficient capacity that is about to be retired. Our knowledge of market and commercial conditions in our five core regions means that we select only the best development or acquisition opportunities across our portfolio.

With non-recourse project debt as a fundamental building block, our capital structure is prudently balanced to provide us with the flexibility to carry out growth initiatives without overstretching our financial resources. We have access to multiple financial resources - including strong cash generation from our portfolio, our borrowing facilities and capacity, and our partnering capabilities - to execute selected opportunities which meet our stringent investment criteria.